|

|

||

|

|

"I'm always making a comeback but nobody ever tells me where I've been." Billie Holiday.

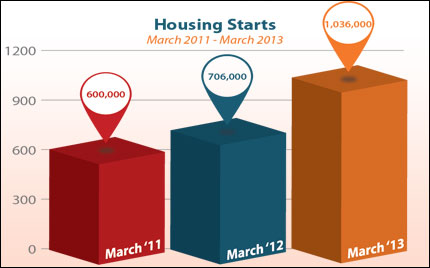

And the evidence continues to show that the housing market is making a

comeback. Read on for details and what they mean for home loan rates.

Housing

Starts spiked by 7 percent in March to 1.036 million units on an

annualized basis, well above the 930,000 expected. This was the largest

rate since June 2008. In addition, Housing Starts were up a whopping 47

percent since the same period last year. Housing

Starts spiked by 7 percent in March to 1.036 million units on an

annualized basis, well above the 930,000 expected. This was the largest

rate since June 2008. In addition, Housing Starts were up a whopping 47

percent since the same period last year.Building Permits, a sign of future construction, did decline by nearly 4 percent to 902,000. But overall, this was a strong report and further evidence of improvement in the housing sector. In other news, the Labor Department reported that the Consumer Price Index (CPI) declined by 0.2 percent in March, showing that inflation at the consumer level remains tame. Weekly Initial Jobless Claims rose by 4,000 to 352,000, with no clear signs of any significant move lower as the labor market continues to muddle along with no meaningful growth. And in the manufacturing sector, the Empire Manufacturing Index was much weaker than expected, falling to 3.1 in April from 9.2 last month. What does all of this mean for home loan rates? The Fed has noted that inflation remains in check and they expect this to continue for some time. The recent inflation and weak jobs data gives the Fed cover to continue its Bond purchase program known as Quantitative Easing, which should continue to benefit Bonds and home loan rates (since they are tied to Mortgage Bonds). The bottom line is that home loan rates remain near historic lows and now is a great time to consider a home purchase or refinance. Let me know if I can answer any questions at all for you or your clients. |

|

|

|

|

|

|

|

Forecast for the Week

|

|

|

|

|

|

|

|

|

This week contains a full slate of important news from start to finish.

In

addition, earnings season continues and the markets will be watching

these reports closely for signs regarding whether our economy is

improving.

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond that home loan rates are based on. When you see these Bond prices moving higher, it means home loan rates are improving -- and when they are moving lower, home loan rates are getting worse. To go one step further -- a red "candle" means that MBS worsened during the day, while a green "candle" means MBS improved during the day. Depending on how dramatic the changes were on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning. As you can see in the chart below, Bonds and home loan rates remain near record best levels. I'll continue to monitor this closely.

Chart: Fannie Mae 3.0% Mortgage Bond (Friday Apr 19, 2013)

|

|

|

|

|

|

|

|

The Mortgage Market Guide View...

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Five Ways to Get More Business From Your Website

Many small to midsize local businesses have ineffective websites and often still rely on traditional media to get leads and drum up new clients. But online search analysis company Chitika reports over 43 percent of all internet search queries are now local. Combine this with declining readership in print publications and Yellow Page use, and local businesses may be looking at a serious problem. Here are five ways to make sure your website keeps up with the rapidly changing face of technology: Go mobile. According to Google and Bing, over 50 percent of web searches made from a mobile device are local and yet 93.3 percent of local business websites are neither mobile compatible nor render correctly from most smartphones. Mobile compatibility is critical as customers will usually move on to the next site within a few seconds if they are required to "pinch and zoom" for information. Be social. According to Marketecture, Inc., a company providing websites for small businesses, 80.5 percent of small businesses don't provide social media links on their website, even if they have a social media presence. Social media is potentially one of the largest sources of free traffic, so make sure your website communicates your presence there. Answer quickly. Email is convenient, fast, and ubiquitous. Getting in touch with you should be the same. Make sure your website has contact information, including email, where it can be easily seen on every page of your website. The same is true for your phone number: make sure it's everywhere on your site and not just the Contact page. Be a resource. If you don't have an "information request" form on your website, connected to both your email and CRM, you're missing out on a great avenue for leads. Make it easy for people to ask questions and receive quick answers, and you will always be rewarded with new business and stronger referrals. SEO is essential. Woody Allen once quipped that 80 percent of success is just showing up. But if your website doesn't show up in search results, you're 100 percent out of the race. A significant source of customers can result from the traffic directed to you by search engine results. Search engine optimization (SEO) using proper keywords, site optimization, and link building are necessary to get search engine ranking. If you don't know how to do it yourself, it's worth hiring specialists. Address these areas on your website and you'll capture a bigger share of local website traffic, improve your customer engagement and, of course, get more leads and new business coming in the door than ever before. Please pass this along to any clients and colleagues who might benefit from these tips.

Economic Calendar for the Week of April 22 - April 26

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

The

material contained in this newsletter is provided by a third party to

real estate, financial services and other professionals only for their

use and the use

of their clients. The material provided is for informational and

educational purposes only and should not be construed as investment

and/or mortgage advice. Although the material is deemed to be accurate

and reliable, we do not make any representations as

to its accuracy or completeness and as a result, there is no guarantee

it is without errors.

As your mortgage professional, I am sending you the

MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

In the unlikely event that you no longer wish to receive these valuable market updates, please

USE THIS LINK or email:

Craig.E.Newby@Wellsfargo.com

If you prefer to send your removal request by mail the address is:

License# 450444

Wells Fargo Home Mortgage

No comments:

Post a Comment