Cool Springs is one of those areas that is part of the Nashville

locals library of places to live and work as well as spend most of the

weekend shopping, but try to find it on a map or search for homes using

"Cool Springs" as the city name and you are going to be out of luck.

Cool

Springs is an area that is really part of Brentwood and Franklin. It's

well know to residents of the Nashville area as the home to Cool Springs

Galleria which is the local shopping attraction for the

Brentwood/Franklin area. There are alos some residential homes for sale

in the immeadiate area, which are known either as Franklin or Brentwood,

which is how they are listed in the MLS, but locals would say they are

in Cool Springs. by Mike Conrad

Top Real Estate Agent in Franklin TN

Wednesday, May 8, 2013

Thursday, May 2, 2013

Franklin TN short sales

What is a Short Sale?

A Short Sale, also known as a pre-foreclosure sale, is when you sell your home for less than the balance remaining on your mortgage. If your mortgage company agrees to a Short Sale, you can sell your home and pay off all (or a portion of) your mortgage balance with the proceeds. Fannie Mae’s program is called Short Sale/HAFA II.A Short Sale is an alternative to foreclosure and may be an option if:

- You are ineligible to refinance or modify your mortgage

- You are facing a long-term hardship

- You are behind on your mortgage payments

- You owe more on your home than it’s worth

- You have not been able to sell your home at a price that covers what you still owe on your mortgage

- You can no longer afford your home and are ready or need to leave by Mike Conrad

Sunday, April 28, 2013

Franklin TN short sale homes

A “short sale” is when you sell your house at a price that is lower than

the balance you owe on your house. Because the proceeds from the sale

of your house falls short of the principle balance you owe the bank, it

is referred to as a “Short Sale”. This type of sale occurs when a

homeowner cannot afford the mortgage payments and the value of the

property drops so that the homeowner cannot refinance his home. The

Bank decides that selling the property at a loss is better than forcing

you into foreclosure.

The Banks have loss mitigation departments that will look at each deal and decide if the bank will agree to a short sale. Each Bank will have their own requirements for approving a short sale. Typically a Bank will have the home appraised and based on that appraisal they will decide if it is better to have you sell the home for less than you owe or if they will make more money foreclosing on you and then selling the house themselves.

If the Bank does agree to the short sale you are still not out of the woods. You will still be responsible for the difference between the short sale proceeds and the remaining balance of your mortgage unless you have it clearly stated in the agreement that you are not responsible for any remaining balances. Even after you get the Bank to forgive the debt you sill have to deal with the Internal Revenue Service (IRS). When you have any debt “forgiven” the IRS considers it to be income. So while you are losing you house because you can’t afford to make the payments the government expects you to pay taxes on the gains you receive. You should always ask a tax professional what the impact of the Short Sale will have on your personal income taxes since there are some exclusions that have recently been put into effect.

Hopefully, the goal of making the definitions of a Short Sale Simple has been achieved. You should seek the services of a licensed real estate professional that specializes in Short Sales before you contact the bank. These Professionals can negotiate with the Bank for you. Also remember to consult with a tax specialist before signing any agreement. by Mike Conrad

Franklin TN short sale agent

The Banks have loss mitigation departments that will look at each deal and decide if the bank will agree to a short sale. Each Bank will have their own requirements for approving a short sale. Typically a Bank will have the home appraised and based on that appraisal they will decide if it is better to have you sell the home for less than you owe or if they will make more money foreclosing on you and then selling the house themselves.

If the Bank does agree to the short sale you are still not out of the woods. You will still be responsible for the difference between the short sale proceeds and the remaining balance of your mortgage unless you have it clearly stated in the agreement that you are not responsible for any remaining balances. Even after you get the Bank to forgive the debt you sill have to deal with the Internal Revenue Service (IRS). When you have any debt “forgiven” the IRS considers it to be income. So while you are losing you house because you can’t afford to make the payments the government expects you to pay taxes on the gains you receive. You should always ask a tax professional what the impact of the Short Sale will have on your personal income taxes since there are some exclusions that have recently been put into effect.

Hopefully, the goal of making the definitions of a Short Sale Simple has been achieved. You should seek the services of a licensed real estate professional that specializes in Short Sales before you contact the bank. These Professionals can negotiate with the Bank for you. Also remember to consult with a tax specialist before signing any agreement. by Mike Conrad

Franklin TN short sale agent

Saturday, April 27, 2013

short sale homes

We represent a number of short sale properties. These can present a

great opportunity for the right buyer. Look to the right and you will

see a number of short sale homes. If you are an investor or looking for

a great deal, a short sale, pre-foreclosure or foreclosure may be right

for you. Give me a call on 615.429.6785 or email me at mike@mikeconrad.net

and let's begin your search today. We have Brentwood TN short sale

homes, Franklin TN short sale homes, Williamson County short sale homes

and Spring Hill TN short sale homes. We also have Nashville short sale

homes, Bellevue short sale homes and more short sale homes.

If you are already working with a REALTOR please be aware that all sales are subject to the seller's lender approval. Buyer's Agent will receive between 1 - 3 percent cooperating compensation depending on final approval of the short sale by the lender.

by Mike Conrad

what is a short sale?

If you are already working with a REALTOR please be aware that all sales are subject to the seller's lender approval. Buyer's Agent will receive between 1 - 3 percent cooperating compensation depending on final approval of the short sale by the lender.

by Mike Conrad

what is a short sale?

Wednesday, April 24, 2013

SilverPointe has highest avg. sales price!

in Middle Tennessee. Wanting to get top dollar for your home? Call me asap or email me. mike@mikeconrad.net

Getting your home sold for Top Dollar in Brentwood TN, Franklin TN or Nashville TN

Getting your home sold for Top Dollar in Brentwood TN, Franklin TN or Nashville TN

229 Heathstone Franklin TN 37069 home sold and closing this friday!

woo hoo! another one about to go into the 2013 books. The Franklin TN, Brentwood TN and Williamson County TN homes for sale market is red hot and homes are selling for at or very near list price, assuming they are in good shape and priced with some sense of reasonableness. by Mike Conrad

Franklin TN homes for sale

Franklin TN homes for sale

Monday, April 22, 2013

Housing market sarts

|

|

||

|

|

"I'm always making a comeback but nobody ever tells me where I've been." Billie Holiday.

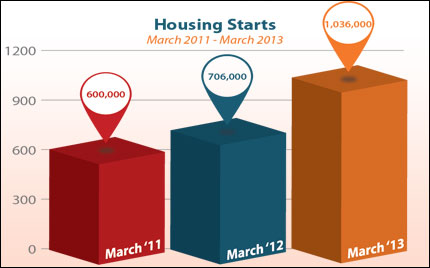

And the evidence continues to show that the housing market is making a

comeback. Read on for details and what they mean for home loan rates.

Housing

Starts spiked by 7 percent in March to 1.036 million units on an

annualized basis, well above the 930,000 expected. This was the largest

rate since June 2008. In addition, Housing Starts were up a whopping 47

percent since the same period last year. Housing

Starts spiked by 7 percent in March to 1.036 million units on an

annualized basis, well above the 930,000 expected. This was the largest

rate since June 2008. In addition, Housing Starts were up a whopping 47

percent since the same period last year.Building Permits, a sign of future construction, did decline by nearly 4 percent to 902,000. But overall, this was a strong report and further evidence of improvement in the housing sector. In other news, the Labor Department reported that the Consumer Price Index (CPI) declined by 0.2 percent in March, showing that inflation at the consumer level remains tame. Weekly Initial Jobless Claims rose by 4,000 to 352,000, with no clear signs of any significant move lower as the labor market continues to muddle along with no meaningful growth. And in the manufacturing sector, the Empire Manufacturing Index was much weaker than expected, falling to 3.1 in April from 9.2 last month. What does all of this mean for home loan rates? The Fed has noted that inflation remains in check and they expect this to continue for some time. The recent inflation and weak jobs data gives the Fed cover to continue its Bond purchase program known as Quantitative Easing, which should continue to benefit Bonds and home loan rates (since they are tied to Mortgage Bonds). The bottom line is that home loan rates remain near historic lows and now is a great time to consider a home purchase or refinance. Let me know if I can answer any questions at all for you or your clients. |

|

|

|

|

|

|

|

Forecast for the Week

|

|

|

|

|

|

|

|

|

This week contains a full slate of important news from start to finish.

In

addition, earnings season continues and the markets will be watching

these reports closely for signs regarding whether our economy is

improving.

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond that home loan rates are based on. When you see these Bond prices moving higher, it means home loan rates are improving -- and when they are moving lower, home loan rates are getting worse. To go one step further -- a red "candle" means that MBS worsened during the day, while a green "candle" means MBS improved during the day. Depending on how dramatic the changes were on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning. As you can see in the chart below, Bonds and home loan rates remain near record best levels. I'll continue to monitor this closely.

Chart: Fannie Mae 3.0% Mortgage Bond (Friday Apr 19, 2013)

|

|

|

|

|

|

|

|

The Mortgage Market Guide View...

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Five Ways to Get More Business From Your Website

Many small to midsize local businesses have ineffective websites and often still rely on traditional media to get leads and drum up new clients. But online search analysis company Chitika reports over 43 percent of all internet search queries are now local. Combine this with declining readership in print publications and Yellow Page use, and local businesses may be looking at a serious problem. Here are five ways to make sure your website keeps up with the rapidly changing face of technology: Go mobile. According to Google and Bing, over 50 percent of web searches made from a mobile device are local and yet 93.3 percent of local business websites are neither mobile compatible nor render correctly from most smartphones. Mobile compatibility is critical as customers will usually move on to the next site within a few seconds if they are required to "pinch and zoom" for information. Be social. According to Marketecture, Inc., a company providing websites for small businesses, 80.5 percent of small businesses don't provide social media links on their website, even if they have a social media presence. Social media is potentially one of the largest sources of free traffic, so make sure your website communicates your presence there. Answer quickly. Email is convenient, fast, and ubiquitous. Getting in touch with you should be the same. Make sure your website has contact information, including email, where it can be easily seen on every page of your website. The same is true for your phone number: make sure it's everywhere on your site and not just the Contact page. Be a resource. If you don't have an "information request" form on your website, connected to both your email and CRM, you're missing out on a great avenue for leads. Make it easy for people to ask questions and receive quick answers, and you will always be rewarded with new business and stronger referrals. SEO is essential. Woody Allen once quipped that 80 percent of success is just showing up. But if your website doesn't show up in search results, you're 100 percent out of the race. A significant source of customers can result from the traffic directed to you by search engine results. Search engine optimization (SEO) using proper keywords, site optimization, and link building are necessary to get search engine ranking. If you don't know how to do it yourself, it's worth hiring specialists. Address these areas on your website and you'll capture a bigger share of local website traffic, improve your customer engagement and, of course, get more leads and new business coming in the door than ever before. Please pass this along to any clients and colleagues who might benefit from these tips.

Economic Calendar for the Week of April 22 - April 26

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

The

material contained in this newsletter is provided by a third party to

real estate, financial services and other professionals only for their

use and the use

of their clients. The material provided is for informational and

educational purposes only and should not be construed as investment

and/or mortgage advice. Although the material is deemed to be accurate

and reliable, we do not make any representations as

to its accuracy or completeness and as a result, there is no guarantee

it is without errors.

As your mortgage professional, I am sending you the

MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

In the unlikely event that you no longer wish to receive these valuable market updates, please

USE THIS LINK or email:

Craig.E.Newby@Wellsfargo.com

If you prefer to send your removal request by mail the address is:

License# 450444

Wells Fargo Home Mortgage

Subscribe to:

Posts (Atom)